Why have one partnership when you can have seven? NCS has picked on that perfect number for its announcement of partnerships to address escalating cyber threats and leverage data insights and artificial intelligence (AI). Its […]

Why have one partnership when you can have seven? NCS has picked on that perfect number for its announcement of partnerships to address escalating cyber threats and leverage data insights and artificial intelligence (AI). Its […]

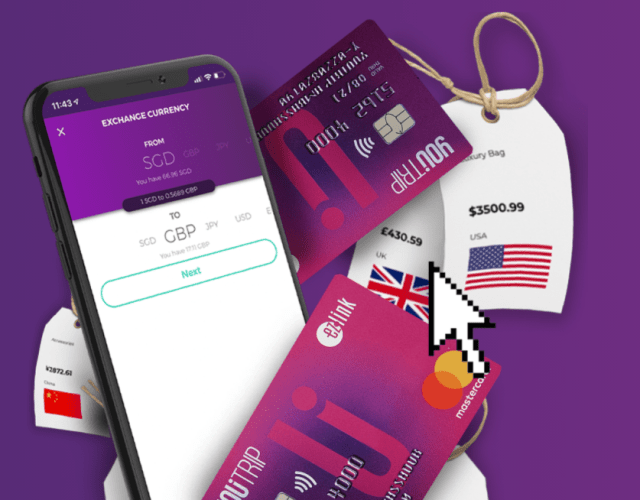

YouTrip has inked a six-year partnership with Visa to accelerate its expansion into Southeast Asia (SEA). With presence in Singapore and Thailand, the fintech startup plans to establish bases in Malaysia and the Philippines. Malaysia […]

Tap to pay via the smartphone is a quick and easy way to make contactless payments. However, businesses are slow in adopting tap to phone solutions even though 55 percent of Asia Pacific consumers surveryed are willing to use this mode of payment.

The number of QR codes for payment is akin to the number of credit card offerings in the market — it keeps growing, making it more of a hassle than convenience for merchants and consumers. The Monetary Authority of Singapore (MAS) has stepped in to solve this problem with the launch of the Singapore Quick Response (SGQR) Code.

The number of QR codes for payment is akin to the number of credit card offerings in the market — it keeps growing, making it more of a hassle than convenience for merchants and consumers. The Monetary Authority of Singapore (MAS) has stepped in to solve this problem with the launch of the Singapore Quick Response (SGQR) Code.

Women in developing countries represent a significant underserved market and commercial opportunity for mobile financial service providers.

Women in developing countries represent a significant underserved market and commercial opportunity for mobile financial service providers.

According to the study by the GSMA mWomen Programme and Visa, more than two billion people worldwide, the majority of whom are women, lack access to basic financial services.

The study, entitled, Unlocking the Potential: Women and Mobile Financial Services in Emerging Markets, focused on women in Indonesia, Kenya, Pakistan, Papua New Guinea, and Tanzania. It was undertaken to gain additional insight into how financial institutions and mobile network operators can better support the complex financial lives of women at the base of the pyramid.