The global cloud infrastructure market rose by 21 percent year-on-year to reach US$90.9 billion in Q1, according to Canalys.

In Q1, enterprises focused on accelerating cloud migration and exploring the adoption of generative AI (GenAI), which relies heavily on cloud infrastructure.

“As AI transitions from research to large-scale deployment, enterprises are increasingly focused on the cost-efficiency of inference, comparing models, cloud platforms, and hardware architectures such as GPUs versus custom accelerators. Unlike training, which is a one-time investment, inference represents a recurring operational cost, making it a critical constraint on the path to AI commercialisation,” said Rachel Brindley, Senior Director of Canalys (now part of Omdia).

“When inference costs are volatile or excessively high, enterprises are forced to restrict usage, reduce model complexity or limit deployment to high-value scenarios. As a result, the broader potential of AI remains underutilised,” said Yi Zhang, Analyst of Canalys.

Market leaders

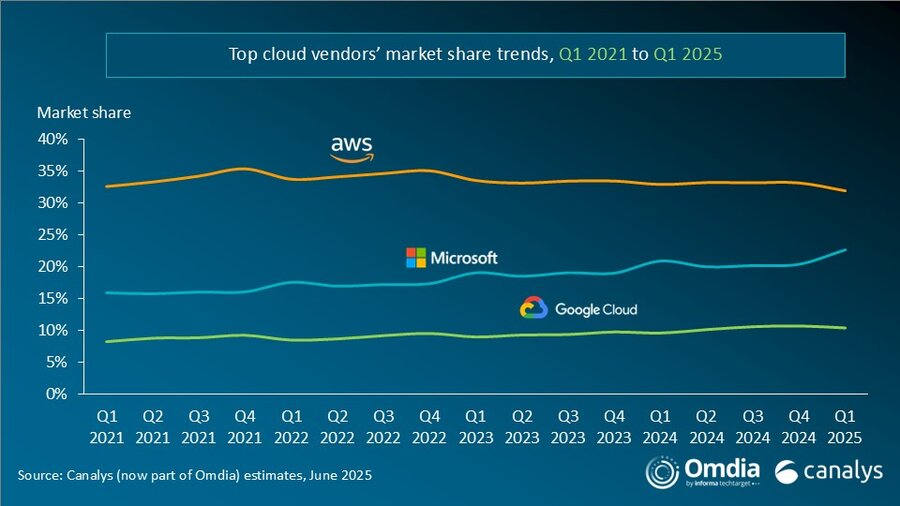

Amazon Web Services (AWS), Microsoft Azure and Google Cloud, which account for nearly two-thirds of worldwide cloud spending, maintained their dominance amid soaring enterprise demand for artificial intelligence (AI) and digital transformation.

AWS remains the leader with 32 percent global market share. The company’s AI business continues to grow at a triple-digit annual rate, though it remains in the early stages of development.

Microsoft Azure has solidified its position as the second-largest cloud provider with 23 percent of the market. It opened new data centres in 10 countries across four continents as part of its ongoing global infrastructure expansion in Q1.

Google Cloud is third with 10 percent market share, delivering strong year-over-year growth of 31 percent. In Q1, the cloud service provider launched its 42nd cloud region in Sweden and committed US$7 billion to expand its Iowa data centre.

Explosive AI adoption

The explosion in AI adoption is a central driver behind the cloud market’s growth. All three hyperscalers are making unprecedented investments to expand their AI model training, deployment and cloud-based application capabilities. This AI-driven demand has, at times, outpaced supply, leading to a tight supply-demand balance and prompting record capital expenditures by the top vendors.

With global cloud infrastructure spending expected to grow by 19 percent in 2025, the race among hyperscalers is not just about offering the best AI services but also about scaling rapidly while maintaining financial sustainability and long-term competitiveness.