Global tablet shipments climbed 9.8 percent year on year to 162 million units in 2025, according to Omdia. Q4 shipments hit 44 million units, up 9.8 percent year on year, fuelled by holiday demand and […]

Global tablet shipments climbed 9.8 percent year on year to 162 million units in 2025, according to Omdia. Q4 shipments hit 44 million units, up 9.8 percent year on year, fuelled by holiday demand and […]

Ant International has introduced the world’s first iris authentication feature for smart glasses-embedded payment solutions through its Alipay+ GlassPay platform. Developed in partnership with Asian smart device makers Xiaomi and Meizu, the innovation signals rapid […]

The global smartphone market shipped 320.1 million units in Q3, a three percent year-on-year increase driven by strong growth in Asia-Pacific and emerging economies, according to Omdia. APAC grew five percent year-on-year, the highest quarterly […]

Vivo has reclaimed the pole position in the China smartphone market in Q3 with 11.8 million units shipped, capturing an 18 percent share, according to Omdia. Huawei ranked second with 10.5 million units and 16 […]

Xiaomi officially opened its largest store in Singapore at Jewel Changi Airport on October 11. Many Xiaomi fans and customers gathered outside the store on Saturday to catch the opening which featured a lion dance. […]

The global market for AI glasses is expected to more than double in 2025 to reach 5.1 million units, and surpass 10 million units in 2026, according to Omdia. The accelerated growth is driven by […]

Xiaomi has opened its first self-managed store in Singapore. Locared at Funan, the store offers dedicated customer support services and product experts. At the new store, customers can enjoy a seamless one-stop shopping experience of […]

The launch of Apple’s iPhone 16 boosted the global smartphone market in Q3. According to IDC, Apple achieved a record-high shipment volume during that quarter, snaring 17.7 percent market share, just a hair’s breadth from […]

Apple continued to lead the global smart personal audio market despite a seven percent year on year shipment decline in Q1, snagging a 22 percent volume share, according to Canalys. Samsung came in second with […]

After 12 years at the top of the global smartphone market, Samsung was dethroned by Apple in 2023. The iPhone maker achieved a record market share and a first time at the top. This comes […]

The global smartphone market continud its downward trend for fifth consecutive quarter, dropping 12 percent year-on-year in Q1, according to Canalys. Samsung snagged the pole position with 22 percent market share, just one percent ahead […]

Strict COVID-19 restrictions and economic demand proved to be a double barrel of bad news for China’s smartphone market in 2022. The market took a hit of 13.2 percent in 2022, with both 2022 and […]

In India’s dampened smartphone market, Xiaomi experienced 18 percent year-on-year declienge in Q3 but managed to hold on to pole position. According to IDC, more than 70 percent of Xiaomi’s shipments went to online channels, […]

Supply shortage and pandemic aside, India’s smartphone market grew seven percent in 2021 to 161 million units, according to IDC. Xiaomi led a band of China makers (Vivo, Realme and Oppo) that dominated the top […]

The supply chain challenge is impacting smartphone market growth. In India, Q3 shipment dropped by 12 percent to 48 million units — after four consecutive quarters of increase, according to IDC. According to Navkendar Singh, […]

Xiaomi has introduced the latest generation of its entry level Redmi 10 smartphone in Singapore. Under the hood are a 50MP hi-res camera, 90Hz 6.5-inch FHD+ AdaptiveSync display and a 2.0GHz octa-core MediaTek Helio G88 […]

Xiaomi grew an impressive 84 percent year-over-year in Q2 as India’s smartphone market recovered from the pandemic with a 86 percent rise, according to IDC. Overall the China phone maker snagged a 29.2 percent market […]

Samsung regained its top spot in the global smartphone market in Q1, nudging Apple off the position it held a quarter ago, according to IDC. The Korea tech giant captured a 20.3 percent marketshare while […]

2020 was a remarkable year for the wearables market. With more people working and learning remotely, demand for such devices rose an astonishing 28.4 percent to 444.4 million units, according to IDC. The research firm […]

Xiaomi has gotten a reprieve from the US court — it has been taken off the list of companies the US claimed to have links to China’s military. If effected, the blacklist would make it […]

Despite a 14.6 percent year-on-year decline, Samsung maintained its pole position in the global smartphone market in 2020, according to Gartner. Apple sailed past Huawei to take the second spot with 3.3 percent annual growth. […]

The success of its iPhone 12 series propelled Apple to the top of the smartphone market with 23.4 percent share in Q4, according to IDC Apple shipped 90.1 million devices in that quarter to drive […]

Qualcomm Technologies has unveiled the Qualcomm Snapdragon 870 5G mobile platform which features an enhanced Qualcomm Kryo 585 CPU prime core clock speed of up to 3.2 GHz. The new platform is designed to deliver […]

Xiaomi has released the new S$89 Mi Watch Lite in Singapore, just in time for the holiday season. Targeted at fitness and health enthusiasts, the device features professional health monitoring and comprehensive display of physical […]

Apple Watches and AirPods have helped to place Apple top of the heap with 33.1 percent share of the global wearables market in Q3, according to IDC. Next was Xiaomi, which experinenced 26.4 percent year […]

Xiaomi has launched its Mi 10T Pro and Mi 10T smartphones in Singapore with availability from November 14. Priced at S$649 for Mi 10T and S$749 for the Mi 10T Pro, the flagship models come […]

Xiaomi was the bright spark in a sea of red as China’s smartphone market slid 14.3 percent year-on-year in Q3, according to IDC. With a 13 percent share, it opened up the gap between Apple […]

Xiaomi held on to pole position as India’s smartphone market enjoyed a double-digit growth in Q3, according to IDC. The China smartphone maker shipped 13.5 million units, growing serven percent year on year (YoY). Despite […]

If you’re using a Pixel, OnePlus, Oppo, realme or Xiaomi smartphone, rejoice because you’ll be the first to enjoy Android 11.

If you’re using a Pixel, OnePlus, Oppo, realme or Xiaomi smartphone, rejoice because you’ll be the first to enjoy Android 11.

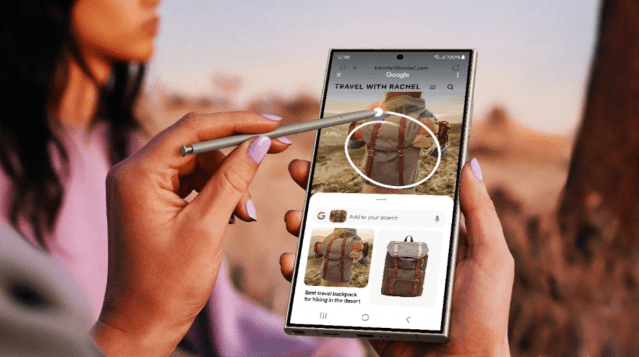

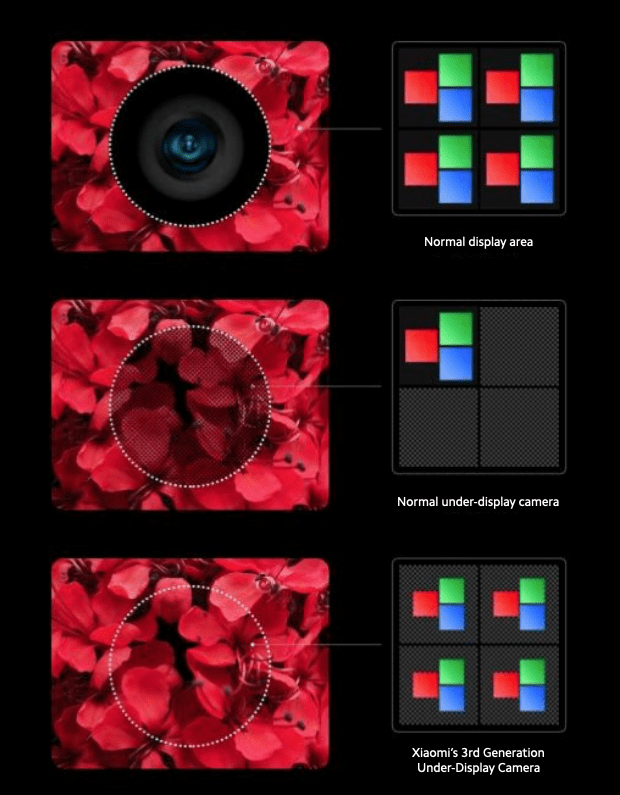

The punch hole or tear drop for the front camera — a common eyesore on smartphones — will be gone for good next year, with Xiaomi smartphones at least.

Xiaomi has rolled out the Mi Curved Gaming Monitor 34″ and Mi Portable Photo Printer in Singapore. Both products are available for purchase online at the official Xiaomi store on Lazada, and offline at Authorised Mi Stores in Singapore and through other official offline retailers.

It seems like only recently that Xiaomi wowed the world with its affordable smartphones that were always sold out at launch. Yet, it has been a decade and the company is looking at building on its smartphone success for the next 10 years.

China Unicom is readying to roll out 5G in China with the support of Qualcomm and in collaboration with device partners nubia, OnePlus, OPPO, Vivo, Xiaomi, and ZTE.

China Unicom is readying to roll out 5G in China with the support of Qualcomm and in collaboration with device partners nubia, OnePlus, OPPO, Vivo, Xiaomi, and ZTE.

For the first time, the smartphone market is on par with the feature phone market in India, according to IDC. Overall, the India market reached 42.6 million units for a 9.1 percent year-on-year growth in Q3.

Smartphone vendors shipped 355.2 million units in Q3, down six percent from the corresponding quarter last year, according to preliminary estimates by IDC. This is the fourth straight quarter of year-on-year decline.

Smartphone vendors shipped 355.2 million units in Q3, down six percent from the corresponding quarter last year, according to preliminary estimates by IDC. This is the fourth straight quarter of year-on-year decline.

Xiaomi and Samsung shipped 9.9 million smartphones each to India in Q2. Together they account for 60 percent of the total shipment that quarter, according to Canalys.

Smart speakers are picking up steam with the installed base expected to hit 100 million by the end of this year, according to Canalys. That’s 2.5 times the size of end 2017.

The long awaited Xiaomi listing made an impressive debut — dropping 2.9 percent on its opening day in Hong Kong. Priced at HK$17.00 at launch, the share price dipped to HK$16.50 in early trading.

The long awaited Xiaomi listing made an impressive debut — dropping 2.9 percent on its opening day in Hong Kong. Priced at HK$17.00 at launch, the share price dipped to HK$16.50 in early trading.

Twenty-two days. It took relatively unknown smartphone maker OnePlus just that amount of time to sell one million units of OnePlus 6, its latest smartphone.

Twenty-two days. It took relatively unknown smartphone maker OnePlus just that amount of time to sell one million units of OnePlus 6, its latest smartphone.

China smartphone makers Huawei and Xiaomi grew strongest as the market recovered in Q1, according to Gartner.

The India smartphone market shipped 30 million units in Q1, the strongest Q1 performance ever and an 11-percent growth year on year, according to IDC.

Xiaomi, one of China’s biggest smartphone makers, has picked Hong Kong for its public listing.

Xiaomi, one of China’s biggest smartphone makers, has picked Hong Kong for its public listing.

In a quarter when the China smartphone market experienced it biggest ever decline, Xiaomi bucked the trend and grew 37 percent to 12 million units, according to Canalys.

In a quarter when the China smartphone market experienced it biggest ever decline, Xiaomi bucked the trend and grew 37 percent to 12 million units, according to Canalys.

Building on a momentum of 155 percent annual shipment growth in India last year, Xiaomi started Q1 at the top with a whopping nine million plus units to snag 31 percent market share, according to Canalys.

India has become the fastest growing smartphone market in the world with total shipment growing 14 percent to 124 million units in 2017, according to IDC.

India has become the fastest growing smartphone market in the world with total shipment growing 14 percent to 124 million units in 2017, according to IDC.

Amazon and Google went head to head in the smart speaker market last year and the battle is expected to be more intense in the coming days with more players joining the fray.

The launch of the iPhone 8 and drop of prices of older models have helped Apple turn in a sterling quarter in China, with shipment rising 40 percent to 11 million units this Q3.

China-based vendors strengthened their grip in the India smartphone market, snaring 51.4 percent share of the smartphone shipment in Q1, according to IDC. They grew 16.9 percent sequentially and an impressive 142.6 percent over the same period last year.

China-based vendors strengthened their grip in the India smartphone market, snaring 51.4 percent share of the smartphone shipment in Q1, according to IDC. They grew 16.9 percent sequentially and an impressive 142.6 percent over the same period last year.

In contrast, share of homegrown vendors dropped to 13.5 percent in the Q1 from 40.5 percent in the same quarter last year.

Overall, 27 million smartphones were shipped in Q1, a 14.8 percent growth over the same period last year. Unlike last year, shipment grew sequentially in the first quarter of 2017 by 4.7 percent recovering from demonetisation impact in Q4.

Huawei has taken top spot again in China’s smartphone market, edging past Oppo after two quarters of trailing in second place. According to Canalys, the Chinese smartphone giant, which launched the P10 and P10 Plus during MWC, shipped close to 21 million units to secure an 18 percent market share in Q1.

Huawei has taken top spot again in China’s smartphone market, edging past Oppo after two quarters of trailing in second place. According to Canalys, the Chinese smartphone giant, which launched the P10 and P10 Plus during MWC, shipped close to 21 million units to secure an 18 percent market share in Q1.

Despite strong annual growth of 55 percent, Oppo fell to second place with shipments of just under 20 million units. Third-placed Vivo had the lowest annual growth of the top three, capturing a 15 percent share with its shipment of 17 million units.

“China’s smartphone market continues to grow, with shipments increasing by over nine percent year on year this quarter. But there is a clear indication that the market is consolidating. The top three vendors are pulling away at the head of the market, accounting for more than 50 percent of shipments for the first time this quarter,” said Lucio Chen, Research Analyst of Canalys.

Everybody knows China is big but with nearly half a billion smartphones shipped last year, the market is massive — that’s one smartphone for every three person in the world’s most populous country.

According to Canalys estimates, China reached 476.5 million unit shipment, growing year on year at 11.4 percent, far exceeding the annual growth rate of 1.9 percent in 2015. China shipment reached 131.6 million units in Q4, which is the highest single quarter total in history, accounting for nearly a third of worldwide shipment.

Huawei took the top spot in the market with 76.2 million shipment, a small lead ahead of runner-up Oppo with 73.2 million units, followed by Vivo in third place at 63.2 million units.

While Samsung remained at the top, China smartphone makers occupied four of the top five positions to snare the lion’s share in India in Q4, according to Canalys.

While Samsung remained at the top, China smartphone makers occupied four of the top five positions to snare the lion’s share in India in Q4, according to Canalys.

Their extremely price-competitive devices pushed out India makers, who have been hit hard by the Indian government’s decision to demonetise the INR500 and INR1,000 (US$7.30 and US$14.65) banknotes.

“Local brands’ target customers typically buy in cash and from independent retailers. With the short-term liquidity crunch caused by demonetisation, these retailers are suffering a slowdown in consumer spending. Local vendors are losing out as retailers look to shift their stock to fast-moving, current devices. In Q4 2015, Micromax, Intex and Lava took second, third and fifth place, accounting for almost 30 percent of the market. One year on and all three vendors have dropped out of the top five, with their collective share falling to around 11 percent,” said Rushabh Doshi, Analyst of Canalys.

Many of us may know Xiaomi as a leading China handphone maker with its unique business model of selling in batches online. In an interesting revelation to Reuters, Xiaomi Global Vice President declared that the […]

Move aside Huawei and Xiaomi because Oppo is now the leader in China’s smartphone market. And the number goes to vivo, another Chinese maker.

According to IDC, the China smartphone market grew 5.8 percent year-on-year and 3.6% quarter-on-quarter in Q3 with Oppo and vivo overtaking Huawei for the first time.

Oppo and vivo rose because the Chinese market has evolved beyond operator and online driven channels over to an offline structure that dovetails with Oppo and vivo’s strengths.

Smartphone sale hit a record 117.3 million in China in Q4. This represents an eight percent growth compared to the same period last year.

Smartphone sale hit a record 117.3 million in China in Q4. This represents an eight percent growth compared to the same period last year.

The phenomenal increase was partly driven by China’s annual singles day online shopping festival in November and Huawei’s strong shipments in the quarter. China’s Q4 growth boosted the calendar year 2015 growth to three percent.

“Xiaomi, Huawei and Apple are the top smartphone players in 2015. This is a stark contrast to the top players in 2013, which was Samsung, Lenovo and Coolpad – with Samsung clearly dominating other players. With operators reducing smartphone subsidy and given the volatility of consumers’ brand preference in the market, the smartphone scene has changed significantly since then,” said Tay Xiaohan, Senior Market Analyst of IDC Asia/Pacific’s Client Devices team.

Huawei has dethroned Xiaomi as China’s top smart phone vendor in Q3. This is Huawei’s first time at the summit of China’s smartphone, according to Canalys. The company powered its way to first place with 81 percent […]

Xiaomi continued its phenomenal growth to regained its crown as the largest smart phone vendor in China with 15.9 percent market share in Q2, according to Canalys. One in three smartphones shipped were from Xiaomi or […]

The combined market share of Chinese brands fell to a two-year low on a global basis, as growth in China slowed to single digit in the first quarter of 2015, according to Canalys Apple increased […]

Xiaomi’s popularity continues to grow as its Redmi Note 4G was sold out in under four minutes in Singapore. It looks like consumers are really drawn by the affordability of the China-made smartphone, which costs […]

Q3 is a stunnin g quarter for smartphones as global shipment broke the 300 million unit barrier for the first time. This represented year-on-year growth of 23 percent, according to Canalys.

g quarter for smartphones as global shipment broke the 300 million unit barrier for the first time. This represented year-on-year growth of 23 percent, according to Canalys.

While Samsung and Apple remain the market leaders, the tussle for the third spot is heating up with was Xiaomi (six percent) followed closely by Lenovo and Huawei at five percent each.

“The global market is becoming more competitive, with vendors beyond Samsung and Apple enjoying growing success. A year ago, in Q3 2013, Samsung and Apple together accounted for 48 percent of worldwide smart phone shipments. While still impressive, in Q3 2014 this had slipped to 38 percent. This trend is likely to continue. It is down to the strong value proposition and increasing quality of products offered across all price points by competing vendors, most notably Chinese companies. In fact, six of the top 10 global vendors in Q3 are based in China,” said Chris Jones, Vice President and Principal Analyst of Canalys.

Xiaomi introduced a slew of products in Beijing yesterday and one that really stood out was Mi Pad, it first tablet powered by the ultra-fast NVIDIA Tegra K1 mobile processor.

Xiaomi introduced a slew of products in Beijing yesterday and one that really stood out was Mi Pad, it first tablet powered by the ultra-fast NVIDIA Tegra K1 mobile processor.

Sporting a 7.9-inch display with 2,048 x 1,536 resolution, this tablet comes with very long battery life — its 6700 mAh battery is good for up to 1300 hours of standby time or 11 hours of video streaming. It features 8MP rear and 5MP front cameras, 2GB of RAM, and 16GB or 64GB of built-in memory. If more storage is needed, there’s a microSD slot.

What’s amazing is under the hood. Powering the Mi Pad is the 192-core NVIDIA Tegra K1 mobile processor, which is based on the parallel processing GPU architecture found in the world’s most powerful supercomputers.