India’s smartphone market reached a five-year high in Q3 of 2025, with total shipments growing 4.3 percent year-over-year to 48 million units, according to IDC. The quarter was marked by robust performances from both Vivo […]

India’s smartphone market reached a five-year high in Q3 of 2025, with total shipments growing 4.3 percent year-over-year to 48 million units, according to IDC. The quarter was marked by robust performances from both Vivo […]

Grab, headquartered in Singapore, is piloting a high-accuracy GPS positioning system to improved location and navigation accuracy of GrabMaps in Singapore. Aimed to enhance the navigation experience for both driver and delivery partners in Singapore, […]

Vivo has reclaimed the pole position in the China smartphone market in Q3 with 11.8 million units shipped, capturing an 18 percent share, according to Omdia. Huawei ranked second with 10.5 million units and 16 […]

The launch of Apple’s iPhone 16 boosted the global smartphone market in Q3. According to IDC, Apple achieved a record-high shipment volume during that quarter, snaring 17.7 percent market share, just a hair’s breadth from […]

After 12 years at the top of the global smartphone market, Samsung was dethroned by Apple in 2023. The iPhone maker achieved a record market share and a first time at the top. This comes […]

New Zealand’s smartphone market dipped 13.5 percent year-on-year (YoY) in Q3, according IDC. Despite this decline, a surge of 10.9 percent compared to the previous quarter hints at a market poised for a potential rebound. […]

The global smartphone market continud its downward trend for fifth consecutive quarter, dropping 12 percent year-on-year in Q1, according to Canalys. Samsung snagged the pole position with 22 percent market share, just one percent ahead […]

Strict COVID-19 restrictions and economic demand proved to be a double barrel of bad news for China’s smartphone market in 2022. The market took a hit of 13.2 percent in 2022, with both 2022 and […]

In India’s dampened smartphone market, Xiaomi experienced 18 percent year-on-year declienge in Q3 but managed to hold on to pole position. According to IDC, more than 70 percent of Xiaomi’s shipments went to online channels, […]

Passwords are a pain. They are much needed yet such frustration for users. Different sites have different password configuration requirements, making password creation an art and a memory challenge. How wonderful it would be if […]

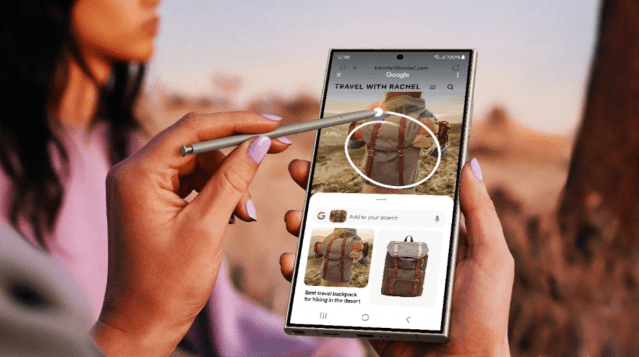

By Inez Lim New to the market, the OPPO Reno8 Pro 5G was introduced on August 19. We’re excited and thankful to have gotten a hold of the latest OPPO Reno8 Pro 5G before its […]

Oppo Research Institute has launched the Innovation Accelerator initiative to empower technology professionals and entrepreneurs to bring innovative solutions to life and help create a better future together. Run in partnership with Microsoft for Startups, […]

Supply shortage and pandemic aside, India’s smartphone market grew seven percent in 2021 to 161 million units, according to IDC. Xiaomi led a band of China makers (Vivo, Realme and Oppo) that dominated the top […]

The supply chain challenge is impacting smartphone market growth. In India, Q3 shipment dropped by 12 percent to 48 million units — after four consecutive quarters of increase, according to IDC. According to Navkendar Singh, […]

Xiaomi grew an impressive 84 percent year-over-year in Q2 as India’s smartphone market recovered from the pandemic with a 86 percent rise, according to IDC. Overall the China phone maker snagged a 29.2 percent market […]

By Edward Lim OnePlus has merged with Oppo, according to reports following a post by Pete Lau, CEO of OnePlus. But, no where in the post is the word “merger” used. The headline reads “A […]

Samsung regained its top spot in the global smartphone market in Q1, nudging Apple off the position it held a quarter ago, according to IDC. The Korea tech giant captured a 20.3 percent marketshare while […]

Despite a 14.6 percent year-on-year decline, Samsung maintained its pole position in the global smartphone market in 2020, according to Gartner. Apple sailed past Huawei to take the second spot with 3.3 percent annual growth. […]

The success of its iPhone 12 series propelled Apple to the top of the smartphone market with 23.4 percent share in Q4, according to IDC Apple shipped 90.1 million devices in that quarter to drive […]

Qualcomm Technologies has unveiled the Qualcomm Snapdragon 870 5G mobile platform which features an enhanced Qualcomm Kryo 585 CPU prime core clock speed of up to 3.2 GHz. The new platform is designed to deliver […]

Xiaomi was the bright spark in a sea of red as China’s smartphone market slid 14.3 percent year-on-year in Q3, according to IDC. With a 13 percent share, it opened up the gap between Apple […]

Xiaomi held on to pole position as India’s smartphone market enjoyed a double-digit growth in Q3, according to IDC. The China smartphone maker shipped 13.5 million units, growing serven percent year on year (YoY). Despite […]

In a battle of the China smartphone makers, Vivo slid ahead of Oppo in Thailand’s smartphone market in Q2. According to IDC, Vivo reached top spot with 19.5 percent market share, thanks to its focus […]

If you’re using a Pixel, OnePlus, Oppo, realme or Xiaomi smartphone, rejoice because you’ll be the first to enjoy Android 11.

If you’re using a Pixel, OnePlus, Oppo, realme or Xiaomi smartphone, rejoice because you’ll be the first to enjoy Android 11.

China Unicom is readying to roll out 5G in China with the support of Qualcomm and in collaboration with device partners nubia, OnePlus, OPPO, Vivo, Xiaomi, and ZTE.

China Unicom is readying to roll out 5G in China with the support of Qualcomm and in collaboration with device partners nubia, OnePlus, OPPO, Vivo, Xiaomi, and ZTE.

Smartphone vendors shipped 355.2 million units in Q3, down six percent from the corresponding quarter last year, according to preliminary estimates by IDC. This is the fourth straight quarter of year-on-year decline.

Smartphone vendors shipped 355.2 million units in Q3, down six percent from the corresponding quarter last year, according to preliminary estimates by IDC. This is the fourth straight quarter of year-on-year decline.

Xiaomi and Samsung shipped 9.9 million smartphones each to India in Q2. Together they account for 60 percent of the total shipment that quarter, according to Canalys.

Oppo has introduced the Oppo A5, its latest mid-range smartphone in China.

Twenty-two days. It took relatively unknown smartphone maker OnePlus just that amount of time to sell one million units of OnePlus 6, its latest smartphone.

Twenty-two days. It took relatively unknown smartphone maker OnePlus just that amount of time to sell one million units of OnePlus 6, its latest smartphone.

China smartphone makers Huawei and Xiaomi grew strongest as the market recovered in Q1, according to Gartner.

In a quarter when the China smartphone market experienced it biggest ever decline, Xiaomi bucked the trend and grew 37 percent to 12 million units, according to Canalys.

In a quarter when the China smartphone market experienced it biggest ever decline, Xiaomi bucked the trend and grew 37 percent to 12 million units, according to Canalys.

Building on a momentum of 155 percent annual shipment growth in India last year, Xiaomi started Q1 at the top with a whopping nine million plus units to snag 31 percent market share, according to Canalys.

The launch of the iPhone 8 and drop of prices of older models have helped Apple turn in a sterling quarter in China, with shipment rising 40 percent to 11 million units this Q3.

New Android mobile phone launches spurred growth in Australia, leading to year-on-year growth of 18.4 percent to 2.16 million units, exceeding expectations in Q2, according to IDC.

New Android mobile phone launches spurred growth in Australia, leading to year-on-year growth of 18.4 percent to 2.16 million units, exceeding expectations in Q2, according to IDC.

Smartphones accounted for nearly all of the shipped phones — totalling 2.06 million.

Android returned to being the most popular smartphone OS in Australia. Recently, iOS had overtaken Android as the most popular smartphone OS in Q4 2016 as it held over 54 percent of the market compared to 47 percent for Android.

China-based vendors strengthened their grip in the India smartphone market, snaring 51.4 percent share of the smartphone shipment in Q1, according to IDC. They grew 16.9 percent sequentially and an impressive 142.6 percent over the same period last year.

China-based vendors strengthened their grip in the India smartphone market, snaring 51.4 percent share of the smartphone shipment in Q1, according to IDC. They grew 16.9 percent sequentially and an impressive 142.6 percent over the same period last year.

In contrast, share of homegrown vendors dropped to 13.5 percent in the Q1 from 40.5 percent in the same quarter last year.

Overall, 27 million smartphones were shipped in Q1, a 14.8 percent growth over the same period last year. Unlike last year, shipment grew sequentially in the first quarter of 2017 by 4.7 percent recovering from demonetisation impact in Q4.

Huawei has taken top spot again in China’s smartphone market, edging past Oppo after two quarters of trailing in second place. According to Canalys, the Chinese smartphone giant, which launched the P10 and P10 Plus during MWC, shipped close to 21 million units to secure an 18 percent market share in Q1.

Huawei has taken top spot again in China’s smartphone market, edging past Oppo after two quarters of trailing in second place. According to Canalys, the Chinese smartphone giant, which launched the P10 and P10 Plus during MWC, shipped close to 21 million units to secure an 18 percent market share in Q1.

Despite strong annual growth of 55 percent, Oppo fell to second place with shipments of just under 20 million units. Third-placed Vivo had the lowest annual growth of the top three, capturing a 15 percent share with its shipment of 17 million units.

“China’s smartphone market continues to grow, with shipments increasing by over nine percent year on year this quarter. But there is a clear indication that the market is consolidating. The top three vendors are pulling away at the head of the market, accounting for more than 50 percent of shipments for the first time this quarter,” said Lucio Chen, Research Analyst of Canalys.

Everybody knows China is big but with nearly half a billion smartphones shipped last year, the market is massive — that’s one smartphone for every three person in the world’s most populous country.

According to Canalys estimates, China reached 476.5 million unit shipment, growing year on year at 11.4 percent, far exceeding the annual growth rate of 1.9 percent in 2015. China shipment reached 131.6 million units in Q4, which is the highest single quarter total in history, accounting for nearly a third of worldwide shipment.

Huawei took the top spot in the market with 76.2 million shipment, a small lead ahead of runner-up Oppo with 73.2 million units, followed by Vivo in third place at 63.2 million units.

While Samsung remained at the top, China smartphone makers occupied four of the top five positions to snare the lion’s share in India in Q4, according to Canalys.

While Samsung remained at the top, China smartphone makers occupied four of the top five positions to snare the lion’s share in India in Q4, according to Canalys.

Their extremely price-competitive devices pushed out India makers, who have been hit hard by the Indian government’s decision to demonetise the INR500 and INR1,000 (US$7.30 and US$14.65) banknotes.

“Local brands’ target customers typically buy in cash and from independent retailers. With the short-term liquidity crunch caused by demonetisation, these retailers are suffering a slowdown in consumer spending. Local vendors are losing out as retailers look to shift their stock to fast-moving, current devices. In Q4 2015, Micromax, Intex and Lava took second, third and fifth place, accounting for almost 30 percent of the market. One year on and all three vendors have dropped out of the top five, with their collective share falling to around 11 percent,” said Rushabh Doshi, Analyst of Canalys.

Three Chinese smartphone vendors — Huawei, Oppo and vivo — helped drive the global smartphone market in Q3. Together their shipment grew 60 percent while the overall global market just moved up six percent that quarter, according to Canalys.

Three Chinese smartphone vendors — Huawei, Oppo and vivo — helped drive the global smartphone market in Q3. Together their shipment grew 60 percent while the overall global market just moved up six percent that quarter, according to Canalys.

The standout performer was Oppo, which had a stellar quarter, taking hold of the Chinese market from under the noses of its rivals. Its smart phone shipments grew around 40 percent sequentially and 140 percent year on year. Tough competition in China has affected Huawei’s global position, with it now looking increasingly unlikely that it will reach its annual shipment target of 140 million units.

Samsung continued to lead the market, but its issues with the Note 7 are starting to affect its business. It shipped just over 76 million units (excluding all Note 7s), down nine percent on the same quarter a year ago. In second place, Apple’s iPhone shipments also suffered an annual decline, falling five percent to just over 45 million units.

The Philippines smartphone market jumped 20 percent in Q1, according to IDC. With a projected annual growth of 25 percent this year, this makes the country the fastest growing smartphone market in Southeast Asia (SEA).

The Philippines smartphone market jumped 20 percent in Q1, according to IDC. With a projected annual growth of 25 percent this year, this makes the country the fastest growing smartphone market in Southeast Asia (SEA).

“While many of the more mature smartphone markets of the world already displayed signs of saturation, the Philippines smartphone market continues to enjoy robust growth owing to a relatively low smartphone penetration rate (30 percent in 2015), active local brand presence, and healthy consumer spending,” said Jerome Dominguez, Market Analyst for Mobile Devices of IDC Philippines.

Local vendors continue to dominate the Philippines smartphone market as they flood it with the most affordable smartphone options.

It’s almost unthinkable but the smartphone market has dipped for the first time in its history.

According to Canalys, worldwide smartphone shipment fell from 324 million units in Q1 2015 to 321 million units in Q1 2016. The top two vendors both posted shipment declines, with Apple the worse hit.

Excluding Apple and Samsung, smartphone shipment grew five percent despite some of the big named international vendors outside the top five also faring badly. LG, Lenovo and TCL-Alcatel posted significant declines, while Sony plummeted by around 57 percent.

Smartphone sale hit a record 117.3 million in China in Q4. This represents an eight percent growth compared to the same period last year.

Smartphone sale hit a record 117.3 million in China in Q4. This represents an eight percent growth compared to the same period last year.

The phenomenal increase was partly driven by China’s annual singles day online shopping festival in November and Huawei’s strong shipments in the quarter. China’s Q4 growth boosted the calendar year 2015 growth to three percent.

“Xiaomi, Huawei and Apple are the top smartphone players in 2015. This is a stark contrast to the top players in 2013, which was Samsung, Lenovo and Coolpad – with Samsung clearly dominating other players. With operators reducing smartphone subsidy and given the volatility of consumers’ brand preference in the market, the smartphone scene has changed significantly since then,” said Tay Xiaohan, Senior Market Analyst of IDC Asia/Pacific’s Client Devices team.